Hong Kong investment immigration has reopened! What should be considered when applying for the New Investment Entrant Scheme?

Savings and InvestmentsArticleNovember 5, 2024

After eight years, Hong Kong Government has reopened the Hong Kong investment immigration policy and the New Capital Investment Entrant Scheme ("New CIES") started to accept eligible applicants from March 1, 2024.

From top-notch educational opportunities to a vibrant business environment and thriving financial market, the charm of Hong Kong has always remained irresistible.

Many interested individuals are highly concerned about the conditions and regulations regarding the investment amount, asset categories and the application process for investment immigration to Hong Kong. What other regulations should be noted? Please refer to the details below (click to go to the relevant section):

- What is the New Capital Investment Entrant Scheme?

- Eligibility: Who can apply for the New CIES?

- If the minimum investment threshold is HKD 30 million? Does purchasing real estate qualify as "Permissible investment assets"?

- Application process and method

- Conditional stay and duration: How long does it take to obtain residency right in Hong Kong?

What is the New Capital Investment Entrant Scheme (CIES)?

"Top Talent Pass Scheme" and "Quality Migrant Admission Scheme" have been well received since launched last year. The Government of Hong Kong Special Administrative Region has also announced the news related to the "New Capital Investment Entrant Scheme" (the "Scheme"), which aims to further enrich the local talent pool and attract more foreign funds to settle in Hong Kong.

The Hong Kong SAR Government has made notable progress in recent years by actively launching various admission schemes for talents and professionals. According to government data, as of June 2024, various talent importation schemes have received a total of over 320,000 applications, with approximately 200,000 approvals.

Exciting news! The Investment-linked Assurance Schemes of Zurich Life Insurance have been accepted as "Permissible Financial Assets" by the Invest Hong Kong and the SFC.

Those Investment-linked Assurance Schemes among market provide death benefits, allowing life insured to achieve investment goals while having life protection. By changing the policyholder/life insured, they support wealth transfer among generations. Zurich provides diversified investment options, becomes top ranking in the market for ILAS products, based on the impressive number of ESG (Environmental, social and governance) investment choices available (as of February 1, 2024).

Eligibility criteria and regulations for application

Eligible applicants' qualifications

According to the regulations, investors are eligible to apply for the Scheme and immigrate to Hong Kong if they satisfy the following criteria:

An applicant, aged 18 or above and is:

- Foreign nationals

- Chinese nationals who have obtained permanent resident status in a foreign country

- Macao Special Administrative Region residents

- Chinese residents of Taiwan

Regulation for net assets amount

An applicant is required to provide evidence that he/she has net assets to which are absolutely beneficially entitled with a market value of not less than HKD 30 million net (or equivalent in foreign currencies) throughout the two years preceding the date he lodged his application.

Entry of dependents into Hong Kong

An approved applicant may bring his/her dependents, including spouse and unmarried children under 18 years old, to Hong Kong.

Minimum investment threshold amount and Permissible investment assets

An applicant must make a minimum investment of HKD 30 million in the Permission investment assets, which include the following requirements:

- The minimum investment threshold is HKD 30 million;

- A minimum of HKD 27 million must be invested in “Permissible financial assets” and “real estate”;

- The remaining HKD 3 million is required to place into a specific “Capital Investment Entrant Scheme Investment Portfolio” (“CIES IP”), which will be set up and managed by the Hong Kong Investment Corporation Limited. The CIES IP will make investment in companies/projects with a Hong Kong nexus, supporting the development of innovation and technology industries and other strategic industries that are beneficial to the long-term development of Hong Kong’s economy.

Permissible investment assets categories and project selection

The Scheme also has strict regulations regarding the categories of “Permissible Financial Assets”, which include:

| Equities | Shares of companies that are listed on the Stock Exchange of Hong Kong (“SEHK”) and traded in HKD or RMB. |

| Debt securities | • Debt securities listed on the SEHK and traded in HKD or RMB (including debt instruments issued in Hong Kong by the Ministry of Finance of the People’s Republic of China and local people’s governments at any level in the Mainland); • Debt securities denominated in HKD or RMB, including fixed or floating rate instruments and convertible bonds1 issued or fully guaranteed by: (A) the Government, the Exchange Fund, the Hong Kong Mortgage Corporation, the MTR Corporation Limited, Hong Kong Airport Authority, and other corporations, agencies or bodies wholly or partly owned by the Government as may be specified from time to time by the Government; or (B) listed companies referred to under paragraph (Equities) above. |

| Certificates of deposits | Certificates of deposits denominated in HKD or RMB issued by authorized institutions as defined in the Banking Ordinance (Cap. 155) with a remaining term to maturity of not less than 12 months at the time of acquisition by applicant and the investment amount is capped at HKD 3 million. |

| Subordinated debt | Subordinated debt denominated in HKD or RMB issued by authorized institutions in compliance with Schedules 4B and 4C of the Banking (Capital) Rules (Cap. 155L). |

| Eligible collective investment schemes | • SFC authorized funds managed by corporations licensed by or institutions registered with the SFC for Type 9 regulated activity; • SFC authorized real estate investment trusts managed by corporations licensed by or institutions registered with the SFC for Type 9 regulated activity; • SFC authorized Investment-linked Assurance Schemes issued by insurers permitted to carry on Class C business as specified in Part 2 of Schedule 1 to the Insurance Ordinance (Cap. 41); • Open-ended fund companies (“OFCs”) registered under the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) and managed by corporations licensed by or institutions registered with the SFC for Type 9 regulated activity. |

Exemption from three types of residential property stamp duty

In addition, based on the Hong Kong SAR Government's Budget for the 2024-2025 financial year on February 28, 2024, all demand-side management measures for residential properties have been abolished with immediate effect. This means that there is no longer any special stamp duty (SSD), buyer's stamp duty (BSD) or new residential stamp duty (NRSD) payable for residential property transactions. Previously, only stamp duty on property ranging from HKD 100 to 4.25% of the transaction price was required.

Details are as follows:

- Special stamp duty: There was a tax of 10% to 20% on the selling price for properties resold within 2 years of purchase earlier while the tax is zero now.

- Buyer's stamp duty: Non-permanent residents of Hong Kong purchasing residential properties in Hong Kong were required to pay a tax of 7.5% of the transaction price earlier while the tax is zero now.

- New residential stamp duty: Non-permanent residents of Hong Kong purchasing residential properties in Hong Kong were required to pay a tax of 7.5% earlier while the tax is zero now.

Application process and method

For details of application process for the “New Capital Investment Entrant Scheme”, please refer to the website of Invest Hong Kong. Here are some key points of the application:

Implementing institutions

Under the Scheme, there are two main implementing institutions:

- The Invest Hong Kong is responsible for reviewing whether applicants meet the net asset assessment and investment requirements;

- Immigration Department is responsible for assessing applications for visa/entry permit, extension of stay and unconditional stay.

Application method

Qualified individuals can submit applications by post or in person to the New CIES Office (Address: 15/F, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong).

For details, please refer to the application required documents, sample forms and relevant guidelines provided by the New CIES Office.

Staying conditions and the right of abode in Hong Kong

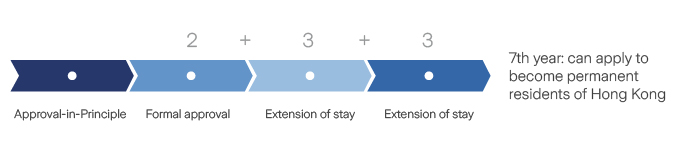

Upon obtaining Approval-in-Principle, applicants can initially stay in Hong Kong as visitors for a maximum of 180 days. Subsequently, they will follow a "2+3+3" year pattern for formal approval, extension of stay and other procedures. They can apply for Hong Kong permanent residency in the seventh year. For more details, you can consult the Immigration Department of the Hong Kong Special Administrative Region or refer to the Frequently Asked Questions section on their website.

Approval-in-Principle: Stay in Hong Kong as visitors for no more than 180 days for making investment.

Formal approval: Receive permission to stay in Hong Kong not more than two years.

Extension of stay: Each extension of stay period for no more than three years.

Right of abode in Hong Kong: Applicants and their dependents may apply to become permanent residents of Hong Kong after a period of continuous ordinary residence in Hong Kong of not less than seven years.

If an applicant may not be able to fulfill the continuous ordinary residence requirement in Hong Kong but meets the financial requirement of the Scheme continuously for no less than seven years, he/she can apply for unconditional stay in Hong Kong. If the application is approved, applicant can freely dispose of the assets invested.

Contact with Zurich

If you would like to learn more about our products, please fill your relevant information in the form below and we will contact you shortly.

About Zurich

Zurich Insurance Group (Zurich) is a leading multi-line insurer serving people and businesses in more than 200 countries and territories. Founded 150 years ago, Zurich is transforming insurance. In addition to providing insurance protection, Zurich is increasingly offering prevention services such as those that promote wellbeing and enhance climate resilience.

Reflecting its purpose to ‘create a brighter future together’, Zurich aspires to be one of the most responsible and impactful businesses in the world. It is targeting net-zero emissions by 2050 and has the highest-possible ESG rating from MSCI. In 2020, Zurich launched the Zurich Forest project to support reforestation and biodiversity restoration in Brazil.

project to support reforestation and biodiversity restoration in Brazil. The Group has about 60,000 employees and is headquartered in Zurich, Switzerland. Zurich Insurance Group Ltd (ZURN), is listed on the SIX Swiss Exchange and has a level I American Depositary Receipt (ZURVY) program, which is traded over-the-counter on OTCQX. Further information is available on our website.

Prepare for the future with our life insurance options

Whether you’re saving to protect your family’s financial future, leaving a legacy for your children, or simply preparing for a rainy day, our extensive line of life insurance plans is here to take care of you and your loved ones, no matter what life brings.