Online Exclusive 20% Off

Breezy Home Insurance Plan (Householder Insurance)

We provide protection for your beloved home from indoor to outdoor home contents, legal liability, accidental death, and more.

Apply now with promo code "HOME20" to enjoy an online exclusive 20% first-year premium discount. Offer ends on March 31, 2026. Terms and conditions apply.

Multiple protections for you and your family members

Home coverage

In addition to covering home contents, accidental deterioration of frozen food, and loss of money, we also provide repair cost coverage for damaged mobile phones and computers

Outdoor coverage

Protects your outdoor home contents, including tables, chairs, washing machines and fridge

Support in various situations

Including cashless emergency assistance services, home content accidental damage during home renovation, and expenses during temporary relocation after an accident

Sustainable elements

In addition to legal liability for using EV charging and repair coverage for solar PV systems, we also offer various green living incentives.

Optional benefits to meet different needs

Worldwide Personal Possessions

Global coverage for loss of personal items including mobile phones, tablet computers, unauthorized use of credit cards, loss of money, and replacement of personal documents, and more due to accidents.

Home Content Top-up

Additional maximum amount per year of up to HKD 2,000,000

Building

If the building's structure is damaged due to an accident, we will pay for the actual costs incurred to rebuild or restore the building to its original condition.

Table of Benefits

| Maximum benefits (HKD) | ||

|---|---|---|

| Gross floor area (sq. ft.)/ Salable floor area (sq. ft.) |

Standard Plan | Popular Comprehensive Plan |

| 700 or below/ 560 or below |

600,000/year | 750,000/year |

| 701 to 1,500/ 561 to 1,200 |

1,000,000/year | |

| 1,501 or above/ 1,201 or above |

1,250,000/year | |

Excess/deductible

For each and every loss from:

- Water damage, typhoon, windstorm or landslip and subsidence: HKD1,000

- Others:HKD500

| Maximum benefits (HKD) | ||

|---|---|---|

| Legal Liability | Standard Plan | Popular Comprehensive Plan |

| (a) Owner's / occupier's / tenant's legal liability | 5,000,000/year and accident | 10,000,000/year and accident |

| (b) Owner's / occupier's / tenant's legal liability | ||

Excess/deductible

Each and every loss: HKD1,000

| Maximum benefits (HKD) | ||

|---|---|---|

| Accidental Death | Standard Plan | Popular Comprehensive Plan |

| Accidental death of any household member | 100,000/accident | 200,000/accident |

| Maximum benefits (HKD) | ||

|---|---|---|

| Emergency Home Assistance Services | Standard Plan | Popular Comprehensive Plan |

| (a) Electrical, plumbing, locksmith assistances | Cashlessc | |

| (b) Recycling and other services | Referral Only | |

Remarks

cLimited to standard hour and standard area.

| Maximum benefits (HKD) | ||

|---|---|---|

| Standard Plan | Popular Comprehensive Plan |

|

| Home Content Top-up | Additional 500,000/ 1,000,000/ 2,000,000/year | |

| Maximum benefits (HKD) | ||

|---|---|---|

| Building | Standard Plan | Popular Comprehensive Plan |

| (a) Accidental damage to the building (including EV Charger and Solar PV System located within insured location) | On rebuilding cost/accident | |

| (b) Debris removal | 5% of rebuilding cost/accident | |

| (c) Architects’ and surveyors’ fee | 5% of rebuilding cost/accident | |

Excess/deductible

For each and every loss from:

- Water damage, typhoon, windstorm or landslip and subsidence: HKD1,000

- Others:HKD500

| Maximum benefits (HKD) | ||

|---|---|---|

| Worldwide Personal Possessions | Standard Plan | Popular Comprehensive Plan |

| (a) Unspecified items | 10,000/item; 50,000/year |

|

| (b) Electronic communication productsd | 2,500/set (Maximum 2 reimbursements per year) |

|

| (c) Laptop/tablet computersd | 2,500/set (Maximum 2 reimbursements per year) |

|

| (d) Unauthorized use of credit cards | 10,000/accident |

|

| (e) Loss of money | 10,000/accident | |

| (f) Replacement of personal documents | 10,000/accident | |

Excess/deductible

HKD500 for each and every loss

Remarks

dMaximum 2 aggregate limit of claims per year, on top of Home content protection.

Comparison of home protection insurance products

|

|

Breezy Home |

Other home insurance products in the market |

|

Limit of home content protection |

Basic Protection limit ranges from HKD 600K to 1.25M Top up your plan with an additional HKD 2M coverage# |

Not common to have top-up options |

|

Special coverages |

Outdoor properties Mobile phones and other electronic communication products (HKD 2,500/item or set) # |

Not common to cover outdoor property and mobile phones or with a relatively lower coverage limit |

|

Emergency home assistance service |

Cashless onsite support for plumbing, electrical or locksmith assistance (only limited to standard hour and standard areas)# |

Most products only provide referral service |

|

Sustainability features |

Cover green equipment including solar PV panel and EV charger* Incentive for using recycling service# Perform carbon offset for your household electricity consumption Renewal discount will be rewarded for your year-on-year household electricity saving |

Not common to have sustainability features |

Frequently asked questions (FAQ)

We will grant a maximum of one (1) additional reimbursement on top of the 2 reimbursements for electronic communication products when you used the recycling service of home electric appliances, desktop computers, laptop computers or electronic communication products by our recognized or designated service provider in a policy year.

You may login to OneZurich to complete the Carbon Neutrality Campaign enrollment form to join this campaign for free. We will help to neutralize the carbon emissions from your household electricity consumption in the previous year, and award you with a certification of appreciation. For details, please click here.

We would like to invite you to join our Carbon Neutrality Campaign. Zurich will neutralize the carbon emissions from your household electricity consumption in the last 12 months by supporting renewable electricity generation! If there’s a year-on-year energy saving in the same household, apart from getting a certificate of appreciation, we will also reward you with HKD 50 renewal discount for your great effort. Simply login to OneZurich complete the form to apply!

You may know more about the sustainability vision and practice of Zurich here.

Instruction

Step 1: Login to OneZurich

Step 2: Press “Join now” on the pop-up message box

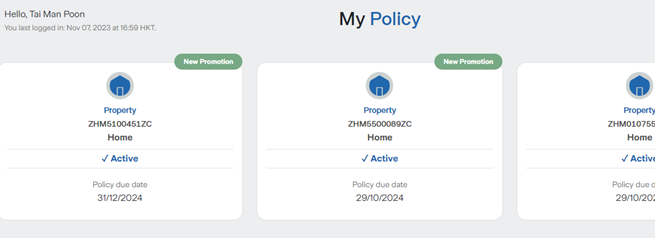

If the pop-up message did not appear, please click in the relevant policy and the pop-up box above would appear.

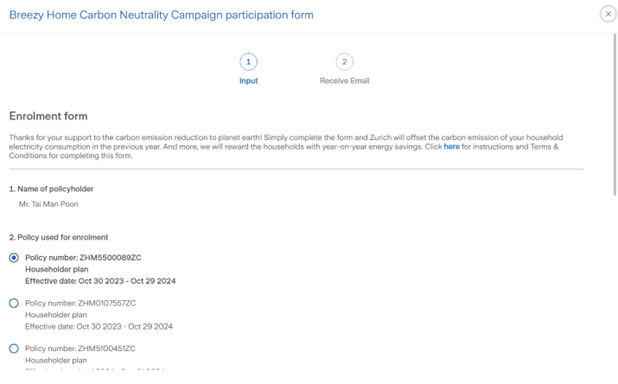

Step 3: Please complete the enrollment form as instructed. Please refer to participation guide for completing form in OneZurich.

Simply login to OneZurich to complete the Carbon Neutrality Campaign enrollment form, Zurich will reward the policyholder with renewal discount if there is a year-on-year electricity saving on the same household. Please click here for details.

- Current policyholders of Breezy Home Insurance Plan (including the householder and landlord insurance) are eligible to join this activity. The householder plan’s policyholders shall submit the electricity consumption of the insured location. The landlord plan’s policyholders shall submit the electricity consumption of the location where they live most days. If the mentioned location is covered by another Breezy Home Insurance Plan (householder), or the policyholder holds more than one landlord policy, the same location is allowed to be used in the submissions for different policies.

- The electricity bill should be issued within three months before the date of submission.

- Each policy is only allowed to have one submission per policy year. The same policyholder of different policies may make submissions corresponding to the insured locations of the policies. For policyholders of Landlord plan, you may submit the electricity consumption figures of your residential address.

- Participants are not required to submit the electricity bills during the form completion. Yet, please keep the electricity bill for possible inspection requests until the certificate is distributed to your nominated email address and/or renewal premium discount is enjoyed.

- Please read the Participation Guide before completing the form.

- Certificate will be sent around 1 working day of submission.

- For the renewal premium discount (the “Discount”), HK$50 will be deducted automatically from the premium upon renewal of Breezy Home Insurance Plan in the next policy year if the submission and eligible is completed within the 1st to the 9th month since policy commencement of the policy year. For submission within the 10th to the 12th month since policy commencement of the policy year, the Discount will be delayed to the policy year after the next. Overdue submission will not be processed.

- The Discount is provided by Zurich Insurance Company Ltd (a company incorporated in Switzerland with limited liability) (“Zurich”). It is only applicable to Breezy Home Insurance Plan.

- The Discount is non-exchangeable for other gifts, non-redeemable for cash, and no change will be given.

- The Discount will be forfeited in case of non-renewal of policy (including cancellation within a policy year).

- In case of change of insured location, please contact our customer service representative to ask for keeping the same policy number to enjoy the Discount in the next (or year after next, if applicable) policy year.

- Zurich reserves all the right of approval and decision on all matters in this activity and the Discount, including the right to change any terms and conditions or terminate the activity and the Discount (in whole or in part) at any time without prior notice.

- In the event of any discrepancy between the English and Chinese versions, the English version shall prevail.

Learn more

- “2026 Home Insurance Premium Discount Promotion” (“Promotion”) is provided by Zurich Insurance Company Ltd (a company incorporated in Switzerland with limited liability) (“Zurich”).

- This Promotion is only applicable to selected Insurance Plan: Breezy Home Insurance Plan (Householder Insurance) and Breezy Home Insurance Plan (Landlord Insurance).

- Customers who apply for the above Insurance Plan(s) through Zurich website with designated promo codes (“Promo code”) from February 2, 2026 to March 31, 2026 (“Promotion Period”) with the policy successfully issued by Zurich and effective on or before March 31, 2026, will be eligible to enjoy 20% first-year premium discount.

- Promo code is subject to a limited quota and is available on a first-come-first-served basis.

- If the customer is also entitled to other prevailing promotional offer(s) in respect of the same policy(ies), Zurich reserves the right to provide only one of such offers to the customer, at Zurich’s sole discretion.

- The date and time appearing in the records of Zurich shall be conclusive as to the date and time relevant to the Promotion Period. Zurich shall not be responsible for any interruption, delay, loss, error or unrecognized information in relation to the application process due to technical problems including any computer or network problems.

- Zurich reserves the right to alter or terminate the Promotion (in whole or in part) or amend the Promotion Terms and Conditions at any time without prior notice.

- In case of any disputes of the Promotion, the decision of Zurich shall be final and conclusive.

- The Promotion discount is non-exchangeable for other gifts, non-redeemable for cash, and no change will be given.

- In the event of any inconsistency between the Chinese and English versions of these terms and conditions, the English version shall prevail.

#Only applicable to Comprehensive plan.

*Only applicable to Comprehensive plan with optional Building coverage.

The insurance plan is underwritten by Zurich Insurance Company Ltd (a company incorporated in Switzerland with limited liability).

The information contained herein is for reference only and does not constitute any part of the insurance contract. For full terms and conditions and exclusions, please refer to the policy document which shall prevail in case of inconsistency. In the event of any discrepancy between the English and Chinese versions, the English version shall prevail. Zurich Insurance Company Ltd reserves the right of final approval and decision on all matters.